Sources familiar with the matter told TechCrunch that General Catalyst, a major U.S. venture capital firm, is in discussions to acquire an India-focused VC firm as part of its efforts to increase its presence in the rapidly growing South Asian startup market.

The potential deal would enable General Catalyst to further engage with India’s thriving technology sector, which has attracted over $100 billion in startup investments since 2010. Although the specific fund being targeted was not disclosed, it is reportedly a sub-$200 million AUM shop. It’s important to note that the deal has not been finalized, so details may change.

While General Catalyst has previously supported around 18 startups in India, such as fintech company CRED, used car marketplace Spinny, and healthtech company Orange Health, the venture firm has been actively seeking to expand its presence in the country for over a year, according to several sources. However, General Catalyst has yet to comment on these efforts.

Last year, the U.S. firm engaged in discussions with various senior figures in India in search of a local partner. Additionally, it began evaluating the possibility of acquiring an India-focused fund as a means of establishing a broader presence in the country. It’s not uncommon for global venture firms to explore this approach as a way to enter the Indian market. Accel, for example, acquired Erasmic more than a decade ago, leading to the creation of Accel India.

With over $25 billion in assets under management, General Catalyst reportedly aims to invest more than $500 million in India over the next three to four years. This decision to focus on India comes after the firm’s expansion in Europe last year through a merger with La Famiglia, an investor in several prominent early-stage startups including AI firm Mistral.

India, known for being one of the world’s largest startup ecosystems, has attracted significant interest from top venture firms such as Sequoia, Lightspeed, Accel, Tiger Global, SoftBank, and Insight Partners over the past decade and a half. Other well-known venture firms, including Coatue Management, QED, and Andreessen Horowitz, have also backed Indian startups in recent years as they cater to the rapidly growing internet market of over 700 million users.

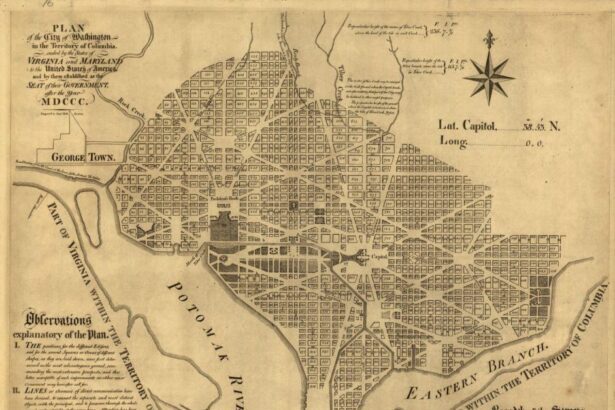

Goldman Sachs’ projection for India. (Image: Goldman Sachs)

Investing in India has posed unique challenges for many global venture firms. According to a partner at an India-based venture firm, while India offers immense potential, the country currently lacks the level of exits seen in the U.S. and does not offer the same scale of returns found elsewhere. This investor stressed that venture firms must accept the longer time horizon required for significant returns in India.

Despite these challenges, global funds, including asset managers, are increasingly focusing on India, which is expected to see its $4 trillion GDP double by the end of the decade, according to Morgan Stanley. Invesco, T. Rowe Price, BlackRock, Fidelity, and UBS are all ramping up their investment in Indian startups through their mutual funds.

Anu Hariharan, founder of VC firm Avra and former head of YC Continuity, highlighted the potential growth in India, stating that by 2030, approximately 15 million developers in the country will be making $50,000 to $75,000 annually. This will amount to around 45 million households earning more than $60,000 a year, surpassing the 28 million households in the UK making $45,000 a year.