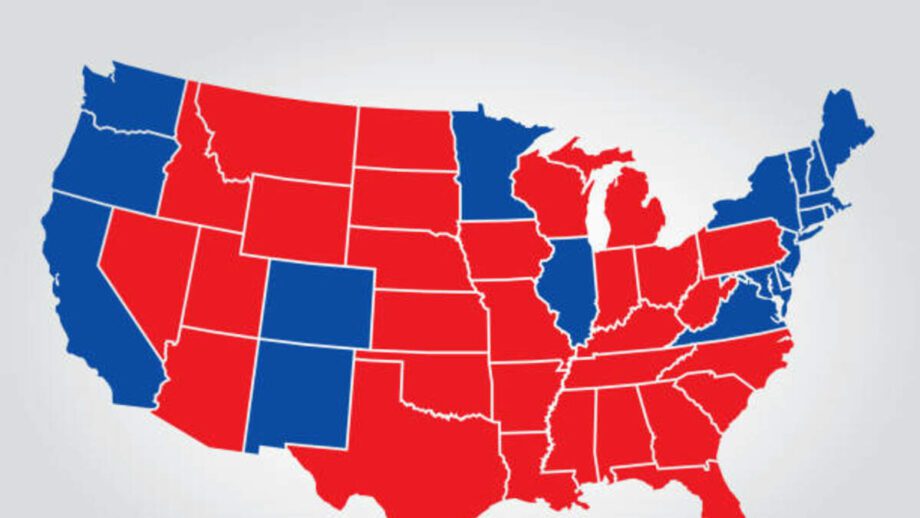

When it comes to wealth in America, where you are matters almost as much as what you have. A new report from GoBankingRates examines the buying power of $100 across all 50 states, and finds a wide variance. A c-note goes the furthest in Arkansas, where $100 will get you about $113 in purchasing power. At the other end of the spectrum is California, where $100 is only good for about $87 in buying power.

Not surprisingly, the states with the worst bang for your hundred bucks were California, Hawaii, Massachusetts, Washington and other blue, high-tax, high-cost locations. Conversely, states like Iowa, North Dakota, and Oklahoma joined Arkansas near the top of the list. Texas was also on the positive side, with $100 here equaling about $103.

For Americans still navigating high prices for food, energy, and especially housing, this report may provide a blueprint for where they can catch a break. “I know the overall inflation number has come down a bit, but the baked-in-the-cake inflation as I call it–which is the inflation you’re still feeling post-pandemic in the goods you buy every day–that inflation is sticky, it’s not going anywhere…especially for insurance and energy costs,” says Richard Rosso, certified financial planner. “So I understand why people are fleeing high-cost states.”

Rosso tells KTRH this pattern of relocation has increased dramatically because of that post-pandemic inflation. “We didn’t see as much of this years ago, because inflation wasn’t high,” he says. “Now that people are so much more sensitive to prices, and they can be more mobile with remote work and technology, there’s a lot of movement across the country going to these low-cost states.”

“It’s a big consideration for a lot of people, and it makes a lot of sense, especially as you get closer to retirement.”